Buying a house is a big deal, especially if it’s your first time. There are a lot of steps involved, but knowing what to expect can make the process much smoother. At Edge Mortgage Inc., we’re here to guide you every step of the way and help you understand how to buy a house from start to finish. Not only that but we can get you approved quickly. We take pride in our speed and quality of service. As a result, we typically have same-day approval once the application has been completed and offer a top-notch experience all around. Undoubtedly, we are your top-rated mortgage broker.

CONTACT EDGE MORTGAGE, INC. TODAY!

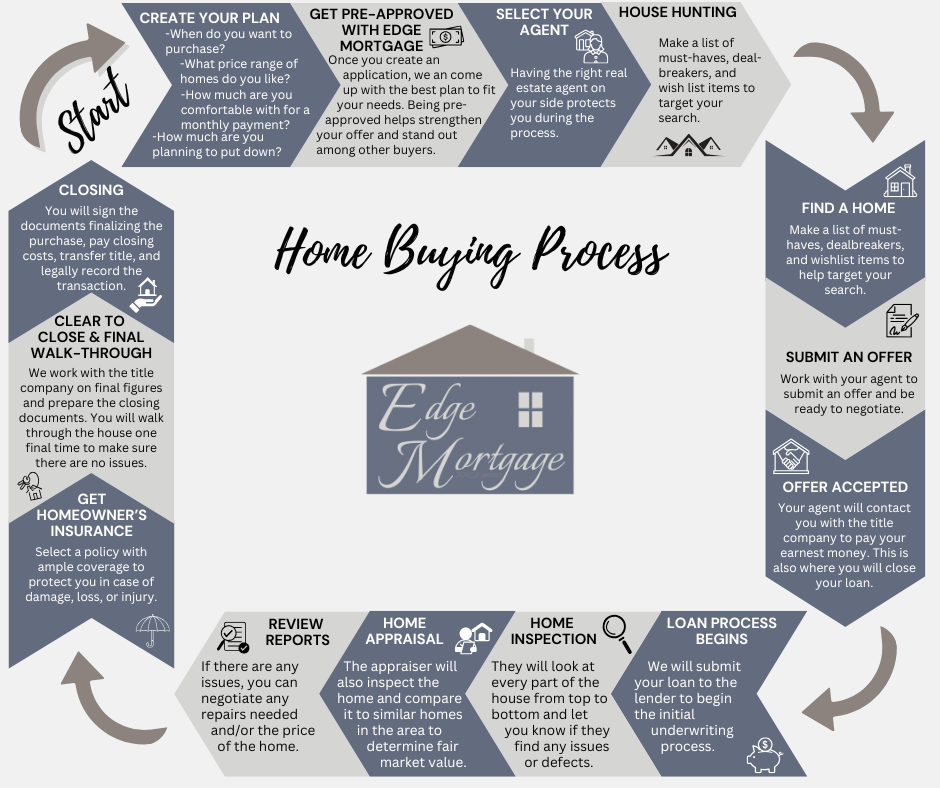

Now that you know to go with Edge Mortgage, Inc. to help you buy your home, it’s important to know more about the things you’ll encounter along the way. One thing to remember is that not all mortgage brokers are created equal. If you choose a broker who is inexperienced or more worried about their bottom dollar than the customer, your experience won’t be as smooth. It’s also important to go with a mortgage broker instead of a bank. So, now that you have those tips under your belt, let’s talk about the steps to buying a home.

How to Buy a Home: 14 Steps In The Home Buying Process

1. Create Your Plan

Firstly, in order to buy a house you’ll need to create a plan that fits your needs. Think about when you’d like to buy and what kind of home you’re looking for. Start by asking yourself a few key questions:

- When do you want to purchase?

- What price range of homes are you interested in?

- How much can you comfortably afford for a monthly payment?

- How much do you have saved for a down payment?

These questions will help you set a realistic budget and timeline, making the next steps much easier.

2. Get Pre-Approved with Edge Mortgage

Getting pre-approved is one of the most important steps in how to buy a house. When you apply for pre-approval with Edge Mortgage, we can create a personalized plan that fits your financial situation. Being pre-approved also shows sellers that you’re a serious buyer and can make your offer stand out among other buyers.

At Edge Mortgage Inc., we’re here to make the pre-approval process simple and straightforward. Once you’re pre-approved, you’ll know exactly what price range you can afford, making your home search much more focused.

3. Select Your Agent

Choosing the right real estate agent is crucial. A knowledgeable agent will protect your interests and help you find the right home at the right price. They’ll guide you through the entire buying process, from searching for homes to negotiating offers. Look for an agent with local expertise and good communication skills—they’ll make your home-buying experience smoother and more enjoyable.

4. Start House Hunting

Now comes the fun part—house hunting! Before you start visiting homes, make a list of your must-haves, dealbreakers, and wishlist items. This will help narrow down your options and keep you focused on properties that meet your needs. Think about things like the number of bedrooms, location, yard size, and any special features you’re looking for.

5. Find a Home

Once you find a home that checks most of your boxes, you’ll be ready to move forward. Work with your agent to make sure the home meets your needs and don’t be afraid to keep searching if it doesn’t feel quite right. After all, this is a big decision!

6. Submit an Offer

When you’re ready to make an offer, your agent will help you determine a fair price and submit the offer to the seller. Be prepared for some negotiation. The seller might counter your offer or you may need to adjust the terms to reach an agreement that works for both sides.

7. Offer Accepted

Congratulations! Once your offer is accepted, your agent will coordinate with the title company to handle the next steps. This is where you’ll pay your earnest money—a deposit that shows you’re committed to buying the home—and start the process of closing your loan.

8. Loan Process Begins

With your offer accepted, the loan process officially kicks off. At Edge Mortgage Inc., we’ll submit your loan application to the lender to start initial underwriting. We handle the paperwork and stay in close contact with you so you know exactly what’s happening and what’s needed at each stage.

9. Home Inspection

A home inspection is essential to identify any potential issues with the property. During the inspection, a professional will examine the house from top to bottom and report on any problems or necessary repairs. This step protects you and gives you the chance to negotiate with the seller if any major issues are found.

10. Home Appraisal

Next, an appraiser will inspect the property to determine its fair market value. They’ll compare the home to similar properties in the area. This step is important for both you and the lender to ensure the property is worth the purchase price.

11. Review Reports

After the inspection and appraisal, it’s time to review the reports. If there are issues, you may be able to negotiate repairs or adjust the purchase price. This is where having a good agent really comes in handy, as they can help you work through these negotiations smoothly.

12. Get Homeowner’s Insurance

Homeowner’s insurance is required by lenders to protect against damage, loss, or injury on the property. Choose a policy with ample coverage and make sure it fits your budget. Your agent or mortgage professional can help you find options if you’re unsure.

13. Clear to Close & Final Walk-Through

Once everything is in order, you’ll get the “clear to close.” This means you’re ready for the final steps! At Edge Mortgage Inc., we work closely with the title company to finalize all documents. You’ll also do a final walk-through of the home to ensure everything is as expected and that any agreed-upon repairs have been completed.

14. Closing Day

Closing day is the big day! You’ll meet at the title company to sign all the necessary documents, pay any closing costs, and officially transfer ownership. Once the title is transferred and the transaction is legally recorded, the home is yours!

Edge Mortgage, Inc. is your trusted mortgage broker in Colorado, Wyoming, Ohio, and Nebraska

There’s a lot to think about when you’re learning how to buy a house, but understanding each step can make the journey smoother and more enjoyable. If you’re ready to take the first step toward homeownership, reach out to Edge Mortgage, Inc. for a personalized consultation. Let us guide you through the pre-approval process, help you find the right loan, and support you all the way to closing. Contact us today to get started on making your dream of owning a home a reality!

Read Some 5-star reviews From Our Happy Clients

“Keri was a pleasure to work with from beginning to end and always had our best interests at heart when comparing different mortgage options. 100% recommend her services to everyone we know” -Kyle

“Keri did an awesome job with our purchasing of a home. She had everything in line with loan upfront. The one thing that helped get the house is she answered her phone on the weekend and talked with the seller’s realtor. I will be using Kari on our next home buy!!” -Nick

START YOUR PRE-APPROVAL PROCESS

Edge Mortgage, Inc. is located in Johnstown, Colorado, and serves Ohio, Colorado, Wyoming, and Nebraska. We offer honest answers and a stress-free process and we have no hidden or extra fees, keeping more money in your pocket. We are your trusted mortgage broker and we are ready to serve you. Call us today at 970-744-0000.

You may also be interested in reading: Top 8 Tips to Increase Your Credit Score